CBN Sets N100,000 Daily Withdrawal Limit for PoS Transactions

CBN Sets N100,000 Daily Withdrawal Limit on PoS Transactions

The Central Bank of Nigeria (CBN) has recently made headlines with its new policy imposing a N100,000 daily withdrawal limit on Point-of-Sale (PoS) transactions. This decision is part of a broader initiative to promote a cashless economy, enhance financial security, and curb fraudulent activities. In this article, we’ll explore what this means for consumers and businesses alike, and how you can adapt to these changes

Understanding the CBN PoS Withdrawal Limits

As of now, the CBN has set a daily limit of N100,000 for individual customers using PoS terminals. This means that regardless of how many transactions you make throughout the day, you cannot withdraw more than this amount from any PoS terminal. Additionally, there is a weekly cap of N500,000 on total withdrawals.

Key Features of the CBN PoS Withdrawal Limits

- Daily Limit: Customers can withdraw a maximum of N100,000 per day.

- Weekly Limit: The cumulative withdrawal limit is set at N500,000 per week.

- Agent Limits: PoS agents can withdraw up to N1.2 million daily.

Why Did the CBN Implement These PoS Withdrawal Limits?

The introduction of these limits aims to address several critical issues within Nigeria’s financial system:

Promoting Cashless Transactions with CBN Limits

By limiting cash withdrawals, the CBN encourages individuals and businesses to adopt electronic payment methods. This shift not only enhances transaction security but also streamlines financial operations.

Reducing Fraud Risks Associated with Cash Withdrawals

The CBN aims to mitigate fraud associated with cash transactions by regulating how much cash can be accessed via PoS terminals. This move is expected to enhance customer confidence in using electronic payment systems.

Encouraging Financial Inclusion Through PoS Transactions

The policy is designed to ensure that more Nigerians can access banking services through agents and PoS terminals, particularly in underserved areas where traditional banking infrastructure may be lacking.

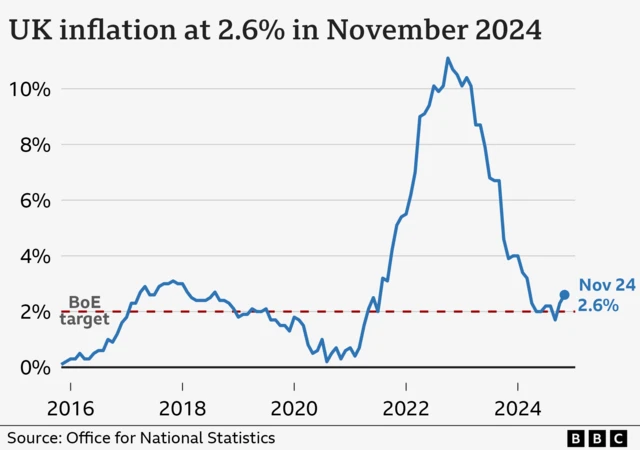

UK Inflation Rate Hits 2.6%: Impact on Families

Impact of the CBN PoS Withdrawal Limits on Consumers

How Will the CBN Withdrawal Limits Affect Your Cash Access?

For many consumers, these new limits may pose challenges:

- Limited Cash Access: Individuals who need more than N100,000 in a day will have to plan their withdrawals more carefully or resort to other means.

- Increased Use of Digital Payments: As cash access becomes more restricted, consumers may need to adapt by using mobile wallets or online banking services more frequently.

Impact of the CBN PoS Withdrawal Limits on Businesses

Adjusting Business Strategies to Meet CBN Withdrawal Limits

Businesses that rely on PoS transactions will also feel the impact:

- Cash Flow Management: Companies requiring larger cash withdrawals for daily operations may need to adjust their cash flow strategies.

- Encouragement of Digital Transactions Due to Withdrawal Limits: Businesses may find themselves needing to invest in digital payment solutions to accommodate their customers’ needs effectively.

Adapting to the New CBN PoS Withdrawal Limits

To navigate the new CBN PoS withdrawal limits effectively, consider these strategies:

- Embrace Digital Payments: If you haven’t already, now is the time to explore digital payment options such as mobile money or bank transfers. These methods can help you avoid the limitations imposed by cash withdrawal caps.

- Plan Your Withdrawals Within CBN Limits: Be mindful of your cash needs throughout the week. If you anticipate needing more than N100,000 in a day, plan your withdrawals accordingly within the weekly limit.

- Stay Informed About CBN Policies: Keep an eye on any further announcements from the CBN regarding changes in policies or limits. Being informed will help you make better financial decisions.

Conclusion

The new CBN PoS withdrawal limits are a significant step towards promoting a cashless economy in Nigeria while addressing issues related to fraud and financial inclusion. While these changes may present challenges for some consumers and businesses, they also offer an opportunity to embrace modern payment solutions that can enhance convenience and security.

for more information visit Central Bank of Nigeria

2 Responses

[…] CBN Sets N100,000 Daily Withdrawal Limit for PoS Transactions […]

[…] CBN Sets N100,000 Daily Withdrawal Limit for PoS Transactions […]