UK Inflation Rate Hits 2.6%: Impact on Families

What is Driving the Rising Inflation Rate in the UK?

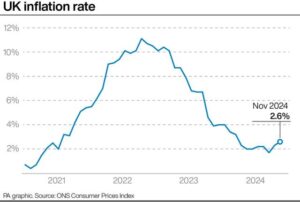

The economic landscape in the UK is currently under scrutiny as inflation rates have surged to 2.6% in November 2024, marking the highest level since March. This rise is primarily attributed to increased costs in petrol and clothing, significantly impacting the cost of living for many families across the nation. As discussions about the effectiveness of current government policies heat up, the keyword “UK” has become a hot topic among economists and everyday citizens alike.

Key Factors Behind the Recent Inflation Surge

According to the latest data from the Office for National Statistics (ONS), inflation rose from 2.3% in October to 2.6% in November, representing the second consecutive month of increases. The primary drivers behind this inflationary trend include rising petrol prices and clothing costs, which have put additional pressure on household budgets.

UK Car Tax 2025: Essential Changes to Vehicle Excise Duty

- Petrol Prices: The cost of fuel has seen a noticeable uptick, contributing significantly to transportation expenses. Higher petrol prices not only affect individual drivers but also lead to increased costs for goods transported across the country.

- Clothing Costs: Clothing prices have also risen, reflecting broader trends in consumer goods where supply chain disruptions and increased production costs are passed on to consumers.

The Chancellor’s Response to Rising Inflation

In light of these developments, the Chancellor has made comments regarding the economic situation, emphasizing that while inflation is a concern, it is essential to consider other economic indicators such as wage growth and employment rates. The Chancellor’s remarks have sparked discussions about whether current government policies are effective enough to combat rising inflation or if new measures are needed.

Guilfoyle Ambassador to Greece: Key Insights

The latest figures indicate that core inflation, which excludes volatile items like energy and food prices, has increased to 3.5%. This suggests that inflationary pressures are not just limited to essential goods but are permeating various sectors of the economy.

Impact of Rising Inflation on Families in the UK

For many families in the UK, rising inflation translates into tighter budgets and difficult choices. The increase in living costs means that households must allocate more of their income toward essentials like fuel and clothing, leaving less for savings or discretionary spending.

- Cost of Living Crisis: The ongoing rise in inflation contributes to a broader cost-of-living crisis that affects millions of families. As prices rise faster than wages, many are finding it increasingly challenging to make ends meet.

- Consumer Confidence: Rising inflation can also dampen consumer confidence, leading to reduced spending on non-essential items. This can create a ripple effect throughout the economy as businesses respond to decreased demand.

Economic Outlook Amid Rising Inflation

As we look ahead, market analysts are closely monitoring the situation. The Bank of England is expected to maintain its current interest rate policy in response to these inflationary pressures. With wage growth reported at 5.2%, there is some optimism that consumer spending can remain robust despite rising prices.

However, economists caution that if inflation continues to rise unchecked, it could lead to more drastic measures from policymakers, including potential interest rate hikes or changes in fiscal policy aimed at curbing spending.

Conclusion

The recent rise in inflation rates in the UK serves as a critical reminder of the delicate balance between economic growth and price stability. As petrol prices and clothing costs continue to climb, families across the nation face increasing financial strain. The Chancellor’s comments highlight the need for effective government policies that address these challenges head-on.

As discussions around inflation persist, it is crucial for consumers to stay informed about their financial options and for policymakers to consider strategies that support households during these turbulent times. The situation remains fluid, but one thing is clear: rising inflation is a pressing issue that will continue to dominate conversations across the UK.

for more information visit

1 Response

[…] UK Inflation Rate Hits 2.6%: Impact on Families […]